You must properly analyze all possibilities to pick the best crypto CFD liquidity provider for your business. Even if choosing the best supplier for you might be challenging, starting with the fundamentals can help significantly. We’ll discuss what liquidity providers are in this article, why they’re essential, and the key elements you should consider when choosing one. Please continue reading if you’re eager to discover more.

CFD Trading Explained

A CFD, or contract for difference, is a deal between two entities to trade the gap in the worth of a financial tool after a certain period of time. Anything from stocks and shares to commodities or currency pairings can be used as an instrument.

Simply said, CFD trading enables you to predict an underlying asset’s price movement without really holding it. If you believe that the price of gold will increase, you might initiate a long CFD position and profit from an increase in the price of gold. Similar to the last example, you could short CFD position and profit from a gold price decline if it falls on markets.

Of course, there is a chance that the price may shift against you, and you will lose money since you don’t own the underlying value. However, with effective risk management, this may be a workable strategy for profiting from the financial markets.

Understanding the risks associated with CFD trading is essential before you begin trading since it is not for everybody. However, it may be a highly successful method of trading the financial markets if you are ready to accept the risks.

Reasons to Provide CFD Trading Services

For traders and investors alike, CFD trading services may provide a variety of advantages. Below are a few basic arguments to think about delivering CFD trading services:

Leverage: You may use leverage to increase your returns while trading CFDs. This implies that you may hold a sizable position with a modest investment. However, it also means that your losses might be increased; thus, while utilizing leverage, it’s crucial to use risk management.

Shorting: You may sell assets on margin via CFD trading. This implies that both price increases and decreases can benefit you. In unstable markets, shorting is one of the most helpful tactics.

Access to global markets: Trading CFDs gives you access to foreign marketplaces. This implies that you might deal with assets coming from various nations and profit from different market circumstances.

Variety of assets: Trading a wide range of assets is possible with CFDs, including stocks, indices, commodities, forex, and more. This provides you with a ton of chances to identify lucrative transactions.

Regulated market: CFD trading occurs in a market that is controlled. Understanding that their transactions happen in a secure and safe environment gives traders comfort and trust.

Low transaction costs: Trading CFDs may be accomplished at a minimal cost. This is a result of the absence of commission on the majority of deals. Furthermore, the margin between the asking price and the bid price is typically extremely small.

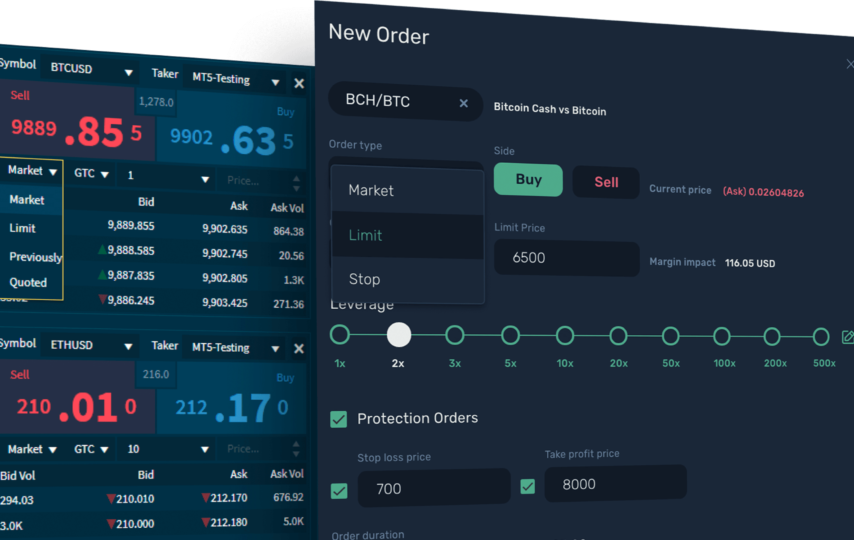

Easy-to-use trading platforms: They are provided by most of CFD providers. This makes it simple for traders of all experience levels to begin trading CFDs.

Bigger lots: Compared to traditional markets, CFD trading enables you to trade wider lot sizes. This implies that you might be able to increase your earnings per deal.

Fast and efficient CFD trades are completed in a matter of seconds. This implies that you can enter and exit deals easily and instantly.

Mentioned above are just a few ways that CFD trading services may be beneficial to traders and investors combined. Be sure to consider all of the issues mentioned above if you’re considering providing CFD trading services. By doing this, you decide whether CFD trading is a good fit for you and your users.

Let’s explore the significance of liquidity in CFD trading before talking about how to choose the best CFD liquidity provider for you.

CFD Liquidity

We refer to the number of buyers and sellers in the market when considering CFD liquidity in the cryptocurrency space. A particular asset has low liquidity if there are not many people trading it, whereas a given asset has high liquidity if many people exchange it.

Since it influences an asset’s price, liquidity is essential. The price will go up when there are more purchasers than vendors. If there are more brokers than customers, the price will decrease. An asset is simpler to purchase and sell at a reasonable cost the more liquid it is.

Since they are still a relatively new asset class, cryptocurrencies are less liquid than more established assets like equities or commodities. This is due to the fact that fewer individuals trade cryptocurrencies, and those who do appear to be more unstable.

However, specific cryptocurrencies have higher levels of liquidity than others. For instance, due to its high trading volume and market capitalization, Bitcoin is the most liquid cryptocurrency. Consequently, because of the tremendous Bitcoin liquidity, it is the most traded cryptocurrency. Another cryptocurrency with good liquidity is Ethereum.

A number of variables have an impact on a cryptocurrency’s liquidity. The principal factor is the coins’ overall value in circulation or market capitalization. The second factor is trading volume or the number of coins traded on any particular day. An additional element is the number of exchanges that trade the coin.

Identifying the Best CFD Liquidity Provider: What to Look for

It’s vital to choose a dependable liquidity source before beginning CFD trading. This is because the liquidity provider will determine the pricing you see on your platform.

The following are some criteria to consider while selecting a CFD liquidity provider:

1) Ensure that the liquidity provider is subject to regulation by an established financial body. By doing this, you may be sure that they are committed to a high level and will charge you appropriately. You may expect narrow spreads and little slippage from a reliable liquidity supplier.

2) Check the availability of deep liquidity pools from the liquidity supplier. More buyers and sellers will be accessible as a result, which will assist in maintaining price stability.

3) Check to see if the liquidity provider’s platform is user-friendly and simple to use. You don’t want to be forced to use a sophisticated platform that makes trading challenging.

4) In addition, examine if the liquidity supplier provides excellent customer service. Every client wants to be able to receive assistance when needed, so check to see whether the customer service is accommodating and supportive.

Using the above criteria, you may select the ideal CFD liquidity provider for your requirements.